HARARE – Residential properties present opportunities for growth in the medium to long term, particularly for the Diaspora market, despite the current fallout from the Covid-19 pandemic, experts say.

Demand for residential properties, which are considered a safe haven for investment, remains high.

Stakeholders who participated in Zimbabwe Property Market 2020 — a virtual property seminar that assessed the impact of the pandemic on the sector and the economy — say residential properties are a fertile ground for investment.

Mr Simbarashe Mupfekeri, a property consultant, said it was time to invest in the sector as prices are presently at their lowest.

The UK’s Centre for Economics and Business Research (CEBR) has already warned that prices of residential properties will tumble 13 percent by year-end.

Seeff Properties managing director Mrs Patience Patongamwoyo indicated that while the general property market would not be spared from the coronavirus fallout, the residential property sub-sector would remain strong.

Before the Covid-19 outbreak, the commercial property sector in Zimbabwe was already struggling with rising voids and downward rental reviews, as companies downsized operations or moved from the central business district (CBD) to residential or office parks.

“Whilst all other property sectors may be affected, with some already affected, residential real estate will not be affected by this pandemic.

“That activities should actually increase as more people adopt to working from home and seek to move into homes that will give them that balance of home and family and social distancing from neighbours,” she said.

Experts say the Diaspora market cannot be overlooked as it is a major source of foreign currency inflows through remittances.

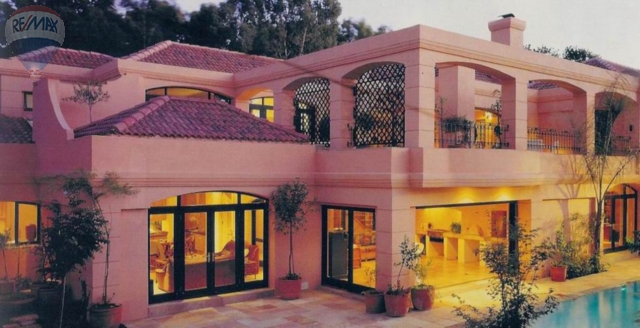

West Properties chief executive officer Mr Ken Sharpe said: “Under the current market, one has to look at the macro environment, that the Diaspora market is undervalued and understated, and without them the economy of Zimbabwe would not have survived.

“We, therefore, need to incorporate them.” He added the country also had an advantage of vast human capital as one of its biggest asset.

The Property Market Zimbabwe 2020 — co-hosted by Financial Markets Indaba (FMI) in partnership with West Property Zimbabwe — also interrogated the general status of the property sub-sectors, strategic purchasing of residential property in Zimbabwe, the mortgage market outlook and the secular changes to expect for the local property sector.

“Covid-19 pandemic is not only drastically altering how we live and work, but where we live and work as well. And that is where the property sector becomes relevant.

The sector will never be the same again. “It is with this in mind that FMI has partnered with West Property Zimbabwe in convening experts with vast experience in property varying from developers, professional property consultants, lenders and construction-related companies to share their perspective,” said FMI business development executive Mr Patrick Muzondo. – Sunday Mail